Trifecta Capital: The secret to delivering a great seed startup pitch

One of the most common questions I get is how to craft a a compelling seed startup pitch. At the seed stage the company is still an infant— perhaps there’s a couple months of revenue, or there’s an exciting technology that the founder is working on. Long financial or operational history is nonexistent.

A way to think about the purpose of a seed stage pitch is through the following mission: Convince the investor of my version of how the world should be.

The most powerful tool at a human’s disposal for convincing what may not be reality today for what should be reality is storytelling.

Humans have prospered for thousands of years partly due to the power of storytelling, creating what Yuval Noah Harari of Sapiens calls our “collective fiction”.

Stories are powerful yet simple mechanisms for painting one’s world view. The most powerful and successful leaders in our society are effective wielder’s of storytelling. They use it to corral others into their vision for the future, making what may have started out as a “fiction” into a tangible reality for a group of individuals. For startup founders story telling is pervasive beyond just the first seed stage pitch. They may have initially already shared their story with a first employee or initial customers and they may go on to tell their company’s story to a sought after VP of Sales candidate, or an equity analyst. Storytelling is a capacity that is critical in bringing to fruition a founder’s vision and plays a role in everything from raising capital to building and retaining a high performing team.

While storytelling exists in different permutations depending on its purpose, this post will focus on the storytelling a founder shares during their seed pitch. I’ll cover the key components of one’s pitch narrative and tips on approaching conversations with investors.

The Pitch

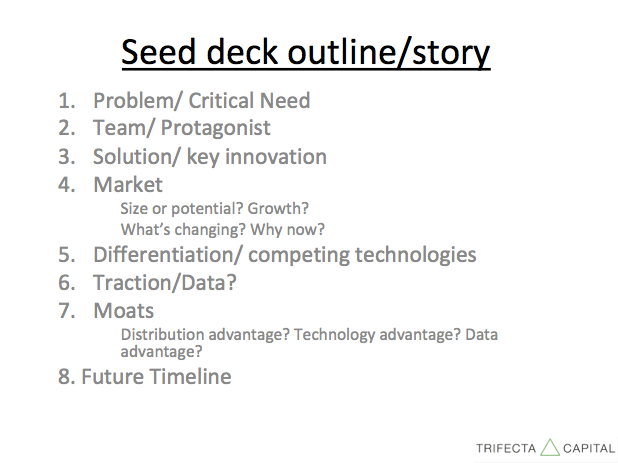

Over the last 5 + years in venture I’ve met hundreds of founders and their pitches come in a variety of flavors and formats. Just how authors tell stories successfully in different ways, founders can tell their story using different methods. There’s no single “right” way or correct formatting for a slide deck. I’ve invested in companies that had no pitch deck at all, as well as those that have shared a full business plan. For those that are looking for tangible advice on how to outline a seed fundraising deck, the following outline (inspired by the storytelling motif I initially introduced) is a useful starting point. Remember though, this is your story — the entrepreneur’s story. Modify the elements if it enables you to more cogently and authentically impart your vision.

Problem/Critical Need

Stories need conflict and like any good story, a strong pitch starts with the problem. The problem is critical for setting the stage because one of the most common reasons a startup fails is lack of product market fit (PMF) — people are not buying the product or using the service. There can be a number of reasons for lack of product market fit (including a poor product) but one of the biggest reasons I’ve seen stems from the initial pain point that sparked the company. In this case of PMF failure, the company’s solution is not addressing a problem that if solved would have a significant impact on individuals or businesses. There’s no market need.

Who cares? If you’re successful, what difference will it make?

Storytelling can play a big role here. Some of the founder’s that I’ve been fortunate to partner with have personally dealt with the pain point they are solving and understand it intimately. For example, the founder’s of EquipmentShare found it challenging to track down, buy, rent, predict costs, store and properly maintain equipment for various jobs while they worked as contractors. EquipmentShare, was birthed out of their wrangling with this pain point and their leveraging of sharing principles that were part of the commune they grew up in in rural Missouri.

Team/Protagonists

In the dictionary, the second definition for protagonist is one that works well for startup founders, as well:

Protagonist

def: an advocate or champion of a particular cause or idea.

synonyms:champion, advocate, upholder, supporter, backer, promoter, proponent, exponent, campaigner, fighter, crusader

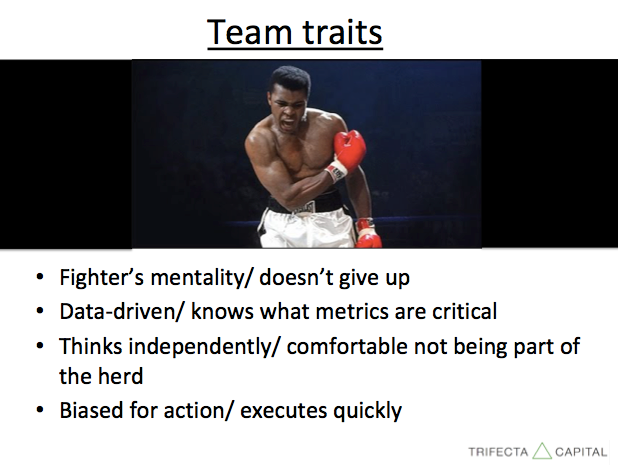

Throughout the early stages of the company the founder is a die hard champion — typically of a philosophy of how the world should work that isn’t popular or widespread. As Alan Kay, a renowned computer scientist once said, “point of view is worth 80 IQ points” — a reminder that looking at things in a new and different way than everyone else can enhance your understanding. Great founder’s tend to have a unique understanding — a differentiated point of view. They also ground that point of view in data and reality.

When introducing the team that is responsible for navigating the startups success, describe with authenticity. Share why you and your team are fighters and how you’ve shown that “fighter’s mentality”. As an investor, I care less about your pedigree and where your degrees might come from, and more about how you think, what motivates you, and your resilience. However, not all investors think this way. There still exists pernicious bias against women and minorities. Meanwhile, some investors have focused on the Stanford network or the Berkeley network, or alums of Google and Facebook and offer preferential treatment and programs for founders coming out these organizations.

Importantly, starting a startup isn’t for the faint of heart of the fly by night. Plato, a Trifecta Capital portfolio company, went through 3 pivots before reaching their current business which turns managers into better leaders through a community of talented, highly engaged mentors. It wasn’t easy, and the team through the process displayed their tenacity and never-give-up mentality that is one of the most important characteristics of successful entrepreneurs. Nothing is an overnight success. Unlike in the movies, with startups, it’s rare that the protagonist triumphs. Can you show how you have the DNA to triumph when the odds are not on your side?

Solution/Key Innovation

If a picture says a 1,000 words, a demo can convey magnitudes more. When possible, show what you’ve created. Additionally, can you explain what you do concisely? How does your key innovation address that aforementioned latent need in a unique and compelling way? What are the benefits and why are they meaningful?

Furthermore, If you have an app in the app the store a product-minded investor’s first step will be to download and try your product out, as well as look at your star rating, reviews and speak with your early users. For example, for one company, in advance to meeting with the founder I noticed that his product was on the software review site, Capterra. I read through many of his apps reviews and while I wasn’t part of his target user group, the reviews helped explain how his solution resonated with users and his key innovations verse competitors. If you have these organic positive ratings, share them in your pitch deck. The voice of your customers can serve to illuminate your compelling solution.

Market

One of the early wisdoms in the venture capital industry was that you had to invest in companies that tackled large markets. As markets evolve rapidly, that wisdom has become modified. As an investor, I look to back companies that address markets that can become large. It is many times advisable to start addressing a small set of highly engaged customers initially.

The second parameter of understanding a market is from the lens of change. The macroeconomic landscape is constantly barraged by agents of change. Change, as I’ve written in the past, is a strong ally of a startup and a foe of most large corporations. Some of the best founder’s I’ve met have shown a nuanced understanding of how the market they are tackling is changing and how the solution they are bringing to market takes advantage of those changes. These changes could be technological (ie: rule-based coding → ML), demographic (ie: aging population), psychographics (ie: preference change from ownership model to sharing/ rental model) or even regulatory (ie: FDA creating an accelerated pathway for approving non-addictive Opioid replacements). By speaking to the proverbial “Why now?” you illustrate the tailwinds that benefit your business (and the headwinds facing large public incumbents).

Differentiation/ competing technologies

Differentiation is rather self-explanatory. However, there’s a deeper nuance to differentiation that investors look at. Are you different in a meaningful way? Human’s have a tough time changing habits. For homo sapiens to adopt something new, the different product/ service/way of working or living has to be at least an order of magnitude better. Provide context on how the pain point you are addressing is addressed today, and the limitations of current practice.

One mistake I’ve seen made in a competition slide is a competitor map based on parameters that don’t matter or aren’t saying anything. For example, a competitor map may graphically distinguish competitors on a spectrum of high price/ low price and high quality/low quality. Putting one’s startup in the low price/ high quality quadrant isn’t telling me anything useful. It’s high level, abstract, and imprecise. What’s more useful is a list of concrete, specific bullet points about what’s unique about your distribution, your product’s experience, your technology and so forth.

Traction/ Data

Know your KPIs (key performance indicators) and share them honestly and transparently.

For company’s that do have traction, many times these KPIs are presented through a growth graph. Do not present a graph on some growth metric that is not one of your KPIs in the pursuit of showing something that is growing 20%+ month over month. This reduces trust and will cause the investor to think that you don’t understand the metrics that are most critical to the success of your business. Additionally, in follow-up interactions, the investor most likely will ask for further metrics that drive your business. During due diligence with one now portfolio company founder, he shared his live google sheets dashboard of every single metric key to his business including granular customer sign-ups. This level of transparency and openness built a huge amount of trust and additionally helped me understand that business more thoroughly to reach a positive investment decision. I’d love to see more founders approach fundraising in this candid and collaborative way. By being forthright with data you can also expedite the due diligence process. For companies that are already into their traction, the investor will ask for this information anyways.

Moats

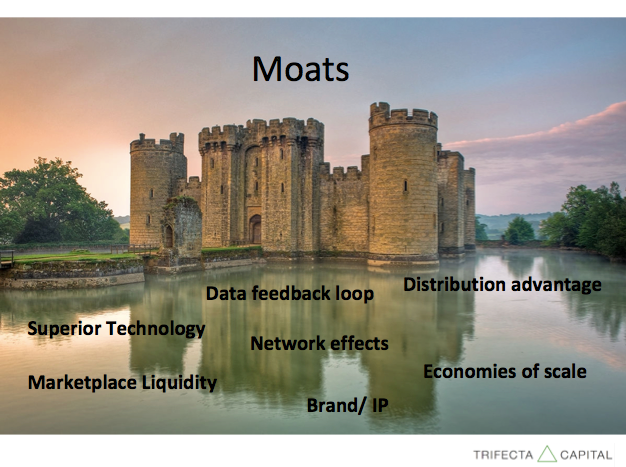

How did the technology giants get so large and dominant? It’s because they wield impressive moats in a number of areas — unique technology, network effects, marketplace liquidity, disruptive distribution advantages, data feedback loops, economies of scale, Brand/IP.

Moats are distinctive aspects of your product or service that enable you to increase your market share and defensibility in the market over time. In other words, moats get deeper and deeper. Unique to powerful moats is the tendency for them to enable monopolistic behavior in a market. They are why we see Google with 80% market share for search, Facebook with over 2 billion users of the almost 4 billion internet users, Amazon with 43% of the eCommerce market in the US, and WeChat with >981 million active users out of China’s 1.4B citizens.

One common moat today that has been discussed ad nauseam is the virtuous data feedback loop. It’s what Google uses to make sure it delivers the most relevant search result by leveraging your previous search history and all other users search history. The virtuous data feedback loop was leveraged during Internet 1.0 with simple A/B testing that improved product adoption/experience etc., and now is especially critical with machine learning companies that live or die based on control of this virtuous data feedback loop that powers their models.

The virtuous data feedback loop, and many other moats, are what Jim Collins, in his book “Good to Great” refers to as a self-reinforcing flywheel. A notable company that took the self-reinforcing flywheel and implemented it throughout its business to massive success is Amazon. In The Everything Store, the following passage succinctly describes Amazon’s flywheel:

“ Lower prices led to more customer visits, More customer visits increased the volume of sales and attracted more commission-paying third-party sellers to the site. That allowed Amazon to get more out of fixed costs like the fulfillment centers and the servers needed to run the website, This greater efficiency then enables it to lower prices further. Feed any part of this flywheel… and it would accelerate the loop.”

In conclusion, to become a business that has longevity and can define a generation, that business needs to build deep moats.

While I hope the perspective shared on developing a pitch is helpful, feel free to share your own thoughts and opinions. One thing I have learned throughout my time in venture is that the past is usually a poor predictor of the future. I expect the format of a startup pitch to continue to evolve over time.

Lastly, I’m always looking to talk to founders, even in the early days during refining of the pitch. If you have a pitch you’d like to share please email me at v @ trifectafund.com !