Bolt.io: On Hardware Startups and Tech Monopolies

Lately, I’ve found myself talking with founders about the dominance of Apple, Google, Amazon, and Facebook. Their monopoly-like powers in software are well known. However, with the exception of Apple, their success at dominating hardware is a relatively recent phenomenon. At each launch event, startups now wait with baited breath to see which of them will be copied (or killed). There’s a growing graveyard:

- Prior to Amazon’s Echo, there was Ivee.

- Prior to the Apple Watch, there was Pebble.

- Prior to the Echo Show, there was Nucleus.

- Prior to Apple’s Airpods, there was Doppler Labs.

With Pixel, Chromecast, Nest, and Dropcam, Google has been building hardware competency for some time. Amazon got ahead of the curve with Lab126 and has seen wild success with both its Kindle and Echo product lines. Facebook’s construction of its Area 404 hardware lab and purchase of Oculus a few years ago indicates that it, too, has hardware platform-building ambitions. For so-called software companies, hardware is in vogue.

The power of vertically integrated products

This focus on hardware is occurring because there’s a growing recognition among tech companies that vertically integrated product experiences keep competition at bay. Deliver just hardware (think Dell), and you tend to get commoditized, as consumers struggle to differentiate features and default to buying the cheapest product. Deliver just software (think Facebook), and you’re limited by the devices through which your app is delivered, subject to sub-optimal design constraints.

But, deliver vertically integrated products with both hardware and software (think Apple), and you can block intrusions by competitors with:

- Increased switching costs: I have 350 books in my Kindle library. The likelihood that I’ll buy a competing e-book reader is zero. Products that store data nudge consumers to shun the competition.

- Decreased friction: Dropcam greatly expanded the number of consumers willing to install a security camera by making it dead simple to do so. Tightly coupled hardware and software enables a better user experience. This sometimes leaves a product category without acute pain points for competitors to solve.

- Data-driven network effects: Each user of Amazon Echo makes their voice recognition algorithms slightly better. In a world driven by machine learning, hardware can enable companies to collect data that their competitors can’t gather. The more users a product has, the more data your company collects. The more data you collect, the better your algorithms will be. The better your algorithms are, the better your user experience is. The better your user experience is, the more users contribute data. This feedback loop increases the power of AI-literate incumbents.

Apple has pursued this integrated hardware/software approach for some time, riding it to become world’s most valuable company. The other tech giants have recognized the need to mimic this and have been searching for the next vertically integrated product opportunities. Most of their focus has centered on products that seek to redefine the very nature of computing.

The Next Platform Wars

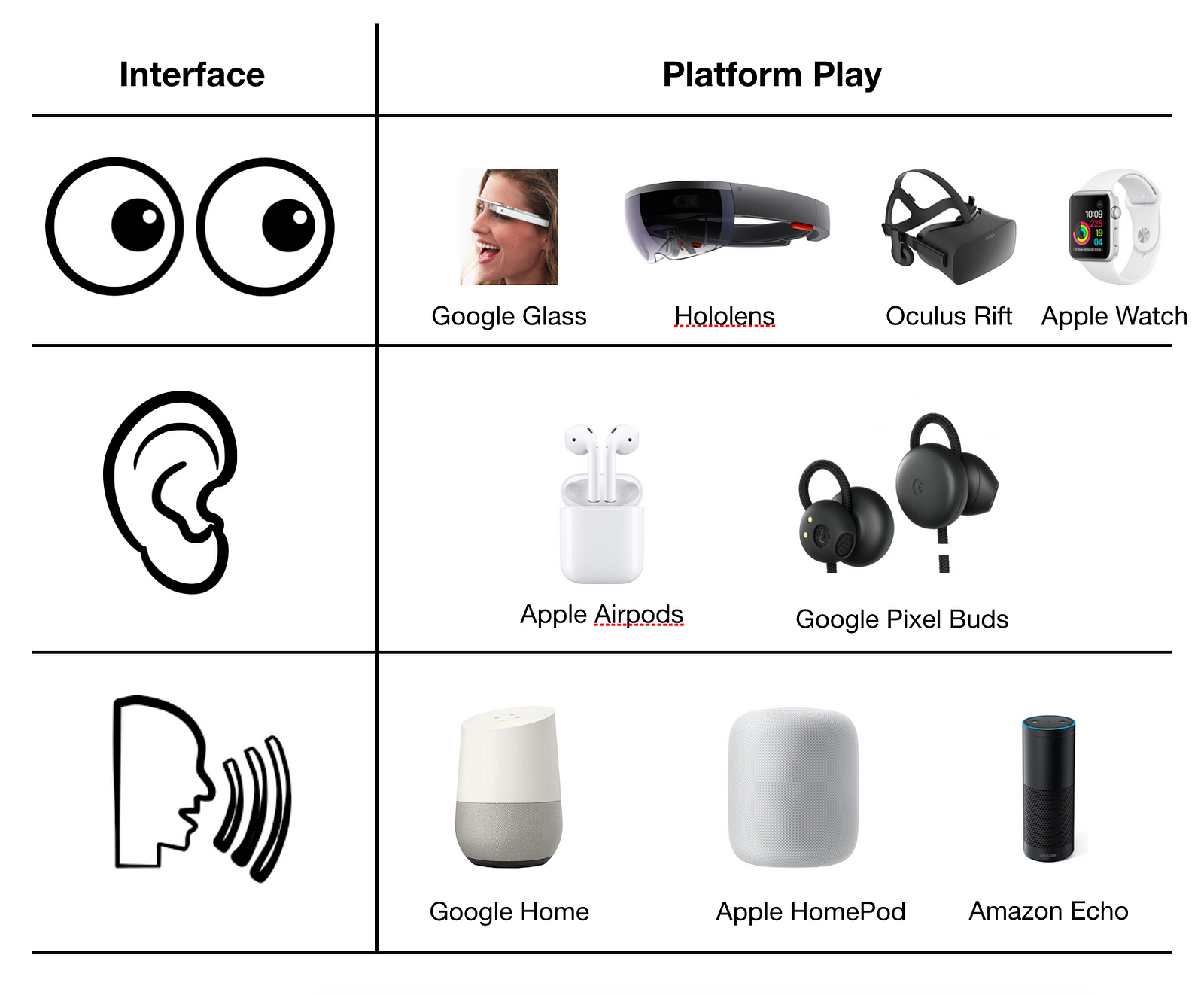

Just as the PC was disrupted by the web browser, and the web browser was disrupted by the smartphone, whoever controls a consumer’s human-computer interface controls the platform. While PCs and smartphones may command the majority of our attention for now, machine learning has enabled new forms of human-computer interaction, making smart speakers, augmented reality, and personal assistant earbuds possible. Should any of these new interaction paradigms reduce our reliance on smartphones, there will be opportunities to disrupt or consolidate today’s digital platforms. Expect the next platform wars to revolve around these frontiers:

While VR headsets, smartwatches, AR glasses, and smart earbuds all hold promise, the smart speaker segment is currently the closest to changing the status quo. Amazon was the most notable first entrant with Echo, and estimates put them at 75% market share. Since then, we’ve seen Apple and Google launch competing speakers of their own.

It’s unclear to me how much value these companies can derive from voice-interaction endpoints throughout my home. Owning an Echo didn’t increase my Amazon usage, and voice is currently a pretty limited UI paradigm. For me, it’s only good for playing media, initiating calls, and turning on/off lights.

While I have doubts that smart speakers are the next big thing, they’re an opportunity to own a piece of a consumer’s physical/digital interface. As these systems improve, there may be ways to nudge consumers to use one platform over another. Google and Amazon know this, and it’s why their smart speaker promotion has been so aggressive.

What this means for startups

Increasingly, big tech companies are shipping hardware without the primary goal of making money. They want ecosystem control. Barriers to entry. Walled gardens of gadgets that keep competitors out. In this kind of environment, it’s nearly impossible for startups to compete.

When working in categories potentially competitive with these monopolies, our advice to founders varies. If it’s in a space with data-driven network effects, founders should try to focus on a niche and re-segment the category, as fitness-focused Fitbit is currently trying to do in the smartwatch space. Otherwise, companies can pivot to B2B and run the other way, as Jawbone did with clinical wearables, without much success.

Either way, when tech monopolies show interest in experimenting outside their core businesses, startup founders should tread carefully. Woe to the startup that tries to compete head-on.

Read the original post on Bolt.io here.